The problem

Agriculture in eastern Africa remains chronically underserved by the financial industry.

Smallholder farmers and agribusinesses, particularly women, lack the financial products they need to buy seeds or fertilisers, or invest in their enterprises.

Awareness about loans and savings is low.

Extreme weather events, such as droughts, that cause crops to fail and pasture to dry up, often result in vulnerable households selling valuable assets, such as land and livestock, that are essential to their future ability to earn money.

When harvests fail, millions of farming families risk being plunged into extreme poverty, simply because they have no financial buffer to fall back on.

The opportunity

Raising awareness amongst farmers and small businesses about savings and loan options enables them to borrow to buy farming inputs or invest in other income-generating activities.

Village saving and loans associations (VSLAs), which offer small loans from pooled savings, can significantly improve rural women’s lives, leading to higher incomes, financial independence and increased confidence.

By diversifying their incomes and insuring their assets against shocks, farmers have more chance of withstanding failed harvests without having to sell their land or let their families or livestock go hungry.

The outcome

By improving their financial management skills, farmers and rural business can apply for loans and develop plans for the funds, allowing them to invest in their next harvest, their families and themselves.

Access to quality education is interlinked with women’s economic empowerment – when women are economically empowered, they tend to send their children to school.

What’s more, contractual agreements between buyers and sellers can boost productivity, increase market competitiveness and promote efficient resource use.

How we increase access to finance

Farm Africa increases rural communities’ access to finance by:

- Working with smallholder farmers and communities to establish VSLAs to provide savings and loan facilities at village level

- Connecting smallholder farmers with savings and credit cooperatives and micro-finance institutions so they can access customised financial services and products

- Working with rural businesses to improve their financial management skills and set them up with funds that graduate them from concessional to formal finance

- Harnessing the power of technologies such as mobile banking

- Facilitating mutually beneficial contracts between farmers, buyers, suppliers and financial institutions

- Leveraging climate adaptation funds to direct resources towards smallholder farmers

Revolving funds

Farm Africa has in-depth experience in helping to set up revolving funds in eastern Africa. A revolving fund is an account where capital is continuously replenished as it is used, allowing for constant lending without reducing the original investment.

Revolving funds are a sustainable way to offer financial support, as loans are repaid, the money is recycled to fund new loans, benefiting communities long-term.

Working capital

Working capital allows rural agribusinesses to pay suppliers, cover operational expenses and ensure they get paid by customers.

We work directly with smallholder farmers to obtain working capital so they can buy produce, expand their businesses, access markets and boost productivity and profitability.

Financial inclusion

A key part of our finance work is providing women with access to finance, including establishing VSLAs and helping women apply for grants and loans from financial institutions so they can grow their businesses.

Farmers are also excluded from access to finance due to cultural and religious beliefs, which prevents them from taking out loans with interest applied such as under Shariah law.

Shariah-compliant financial service provisions were almost non-existent in Amhara in Ethiopia before the start of our Sida-funded Market Systems project. The project developed inclusive financial products including the provision of interest-free loans to support agricultural input and output financing.

Related resources

Country

Tanzania

Key focus areas

Increase access to finance

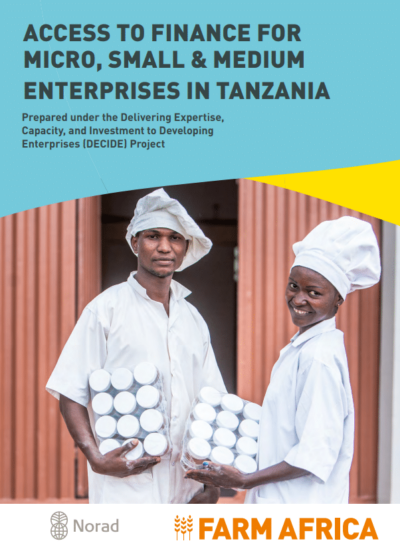

Available Financing Options for MSMEs in Tanzania

An overview of the challenges micro, small and medium-sized enterprises (MSMEs) face accessing finance in Tanzania, with recommendations on how the situation can be improved.

Download (1.63mb)

Country

Tanzania

Key focus areas

Increase access to finance

Country

Tanzania

Key focus areas

Boost productivity

Connect farmers to markets

Increase access to finance

Support businesses

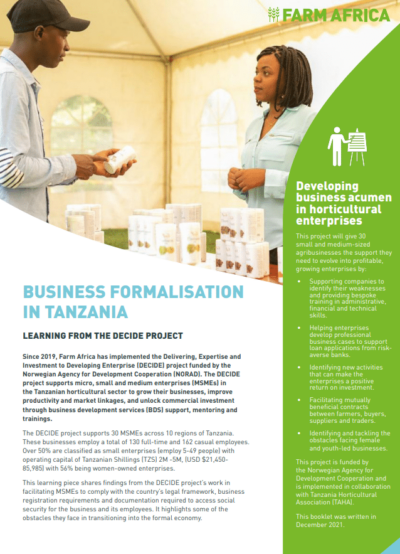

Business formalisation in Tanzania – Learnings from the DECIDE project

This learning piece shares findings from Farm Africa’s DECIDE project’s work in facilitating MSMEs to comply with Tanzania’s legal framework, business registration requirements and documentation required to access social security for the business and its employees. It highlights some of the obstacles they face in transitioning into the formal economy.

Download (1.87mb)

Country

Tanzania

Key focus areas

Boost productivity

Connect farmers to markets

Increase access to finance

Support businesses

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses

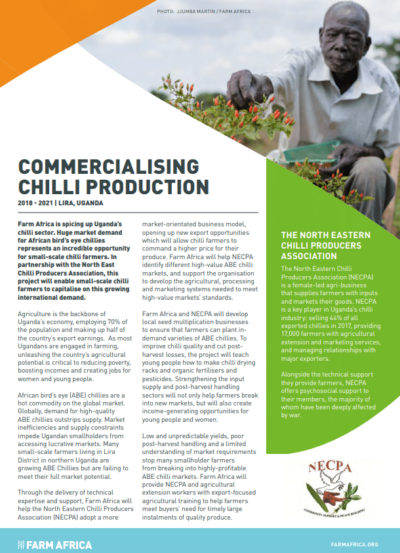

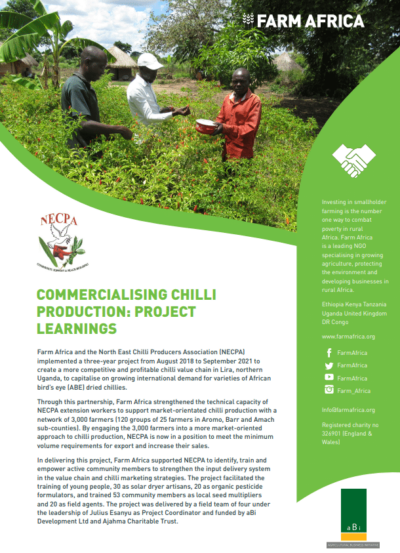

Commercialising chilli production: Project learning

An overview of the key learnings gained from Farm Africa’s chilli project in Lira, northern Uganda.

Download (4.89mb)

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses

Country

DR Congo

Key focus areas

Act on climate change

Boost productivity

Boost youth employment

Connect farmers to markets

Empower women

Increase access to finance

Increase food security and nutrition

Increase incomes

Protect ecosystems

Strengthen food systems

Support businesses

Farm Africa strategic plan 2021-2025

Farm Africa is a leading NGO specialising in promoting sustainable agricultural practices, strengthening markets and protecting the environment in rural Africa. Our strategic plan for the years 2021-2025 outlines our ambitious plan to grow and unlock the potential of agriculture to transform rural Africa.

Download (1.47mb)

Country

DR Congo

Key focus areas

Act on climate change

Boost productivity

Boost youth employment

Connect farmers to markets

Empower women

Increase access to finance

Increase food security and nutrition

Increase incomes

Protect ecosystems

Strengthen food systems

Support businesses

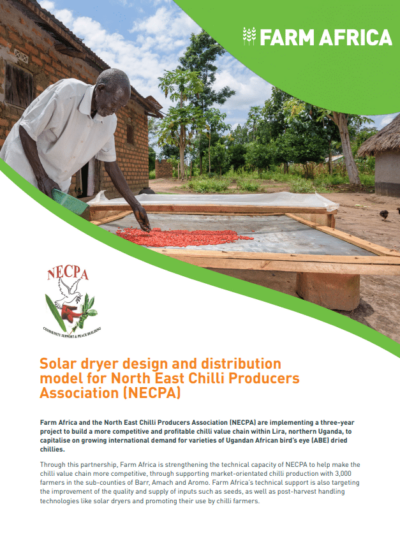

Solar dryer design and distribution model for North East Chilli Producers Association (NECPA)

More info

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses

Solar dryer design and distribution model for North East Chilli Producers Association (NECPA)

Download (3.43mb)

Country

Uganda

Key focus areas

Connect farmers to markets

Increase access to finance

Support businesses